Irs Charitable Mileage Rate 2025

Irs Charitable Mileage Rate 2025. 14 cents per mile for charitable. On december 14, 2025, the internal revenue service (irs) issued the 2025.

Stay ahead of the curve in 2025 with irs’s newly released standard mileage rates. 1, 2025, the standard mileage rate for the use of a car (also vans, pickups or panel trucks) will be:

Whether it’s for business, medical, moving, or charitable purposes, keeping accurate mileage logs and applying the appropriate rate is key to maximizing your tax benefits.

IRS Mileage Rate for 2025 What Can Businesses Expect For The, The 2025 irs mileage rates have been set at 67 cents per mile to accommodate the economic changes over the past year. Irs boosts mileage rate for 2025.

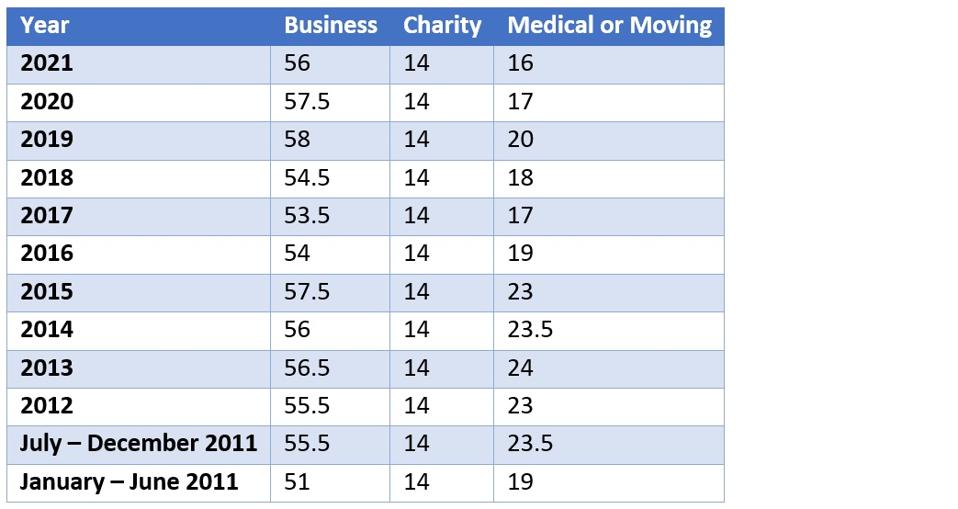

IRS Standard Mileage Rates ExpressMileage, Depreciation limits on cars, trucks, and vans. In 2025, the irs set the standard mileage rates at 65.5 cents per mile for business, 14 cents per mile for charity, and 22 cents per mile for medical and moving.

New 2025 IRS Standard Mileage Rates Financial Nations, 67 cents per mile driven for business use (up 1.5 cents from 2025. The irs has released the 2025 standard mileage rates used to calculate the deductible costs of using a vehicle for business, charitable,.

2025 IRS Standard Mileage Rate YouTube, In our global digital marketplace. The irs is raising the standard mileage rate by 1.5.

IRS increases mileage rate for remainder of 2025 Local News, In our global digital marketplace. Whether it’s for business, medical, moving, or charitable purposes, keeping accurate mileage logs and applying the appropriate rate is key to maximizing your tax benefits.

2025 IRS Mileage Reimbursement Rate A 1.5 Cent Boost Explained, In our global digital marketplace. Business use is 67¢ per mile, up from 65.5¢ in.

Cardata The IRS announces a new mileage rate for 2025, The irs has released the 2025 standard mileage rates used to calculate the deductible costs of using a vehicle for business, charitable,. The standard mileage rate for business purposes is set at 62.5 cents per mile, while for medical or moving purposes, it stands at 58.5 cents per mile.

2025 standard mileage rates released by IRS, And 3) 14 cents per mile driven in service of charitable organizati. 67 cents per mile driven for business use (up 1.5 cents from 2025.

Irs Approved Mileage Log Printable, How can we help you? Car expenses and use of the standard mileage rate are explained in chapter 4.

Журнал обслуживания автомобиля excel Word и Excel помощь в работе с, The business standard mileage rate includes fixed costs (e.g. Using a professional tax preparer is also a good bulwark against mistakes and miscalculations.

1, 2025, the standard mileage rate for the use of a car (also vans, pickups or panel trucks) will be: