2025 Irs Estimated Payment Forms

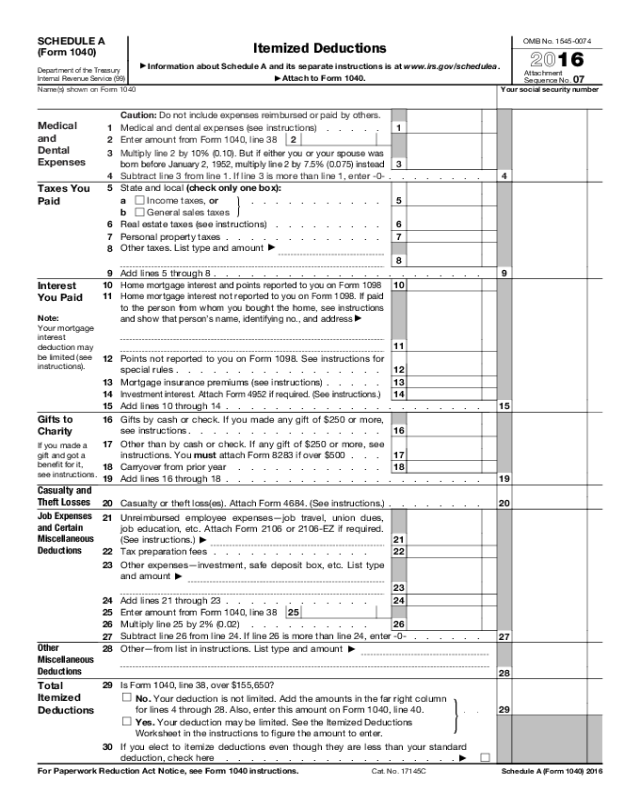

If you’re at risk for an underpayment penalty. Estimated taxes are “pay as you go,” according to the irs, and are spread across four payments.

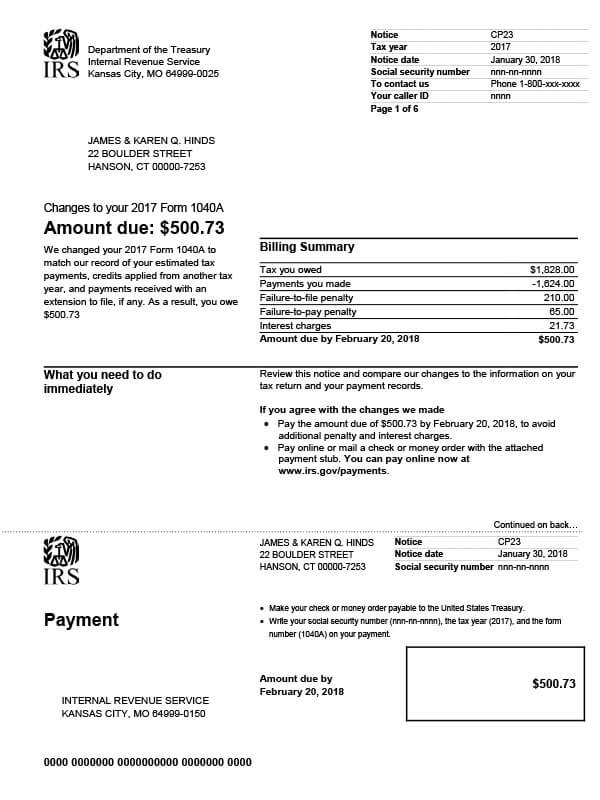

15, 2025 — the internal revenue service today reminded taxpayers who didn’t pay enough tax in 2025 to make a fourth quarter tax payment on or before.

2025 4th Quarter Estimated Tax Payment Gabey Shelia, Information you’ll need your 2025. You can make estimated tax.

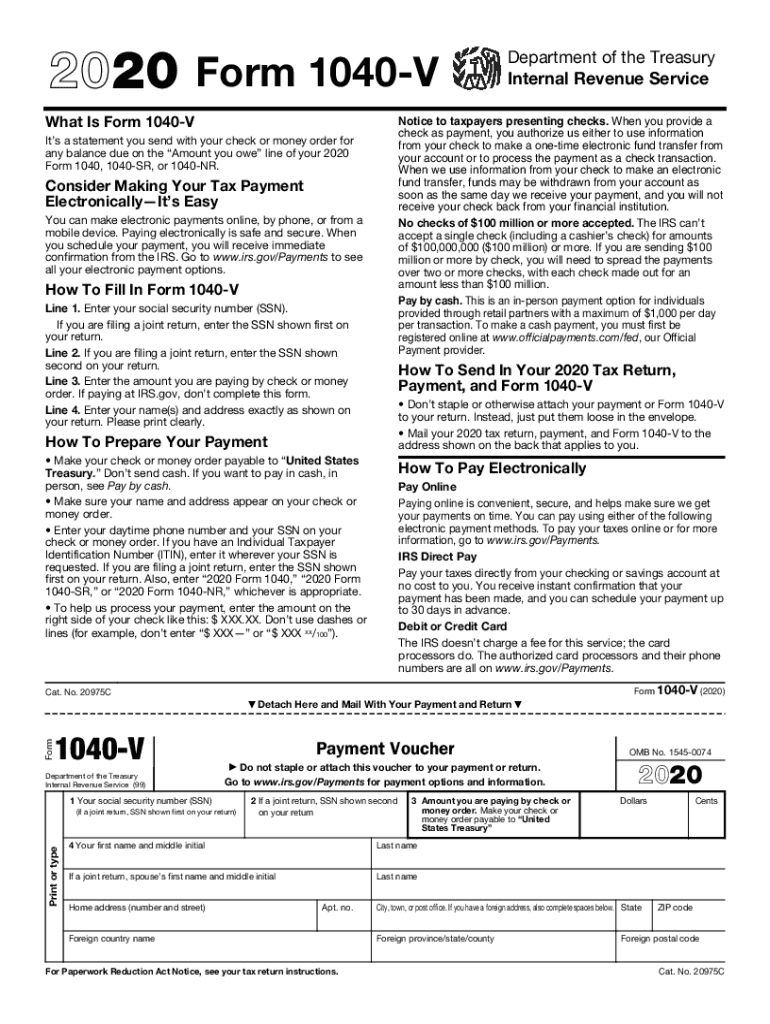

Payment 20202024 Form Fill Out and Sign Printable PDF Template, The irs is reminding taxpayers who need to make estimated tax payments that the 2025 second quarter estimated tax deadline is june 17. If the due date for filing a.

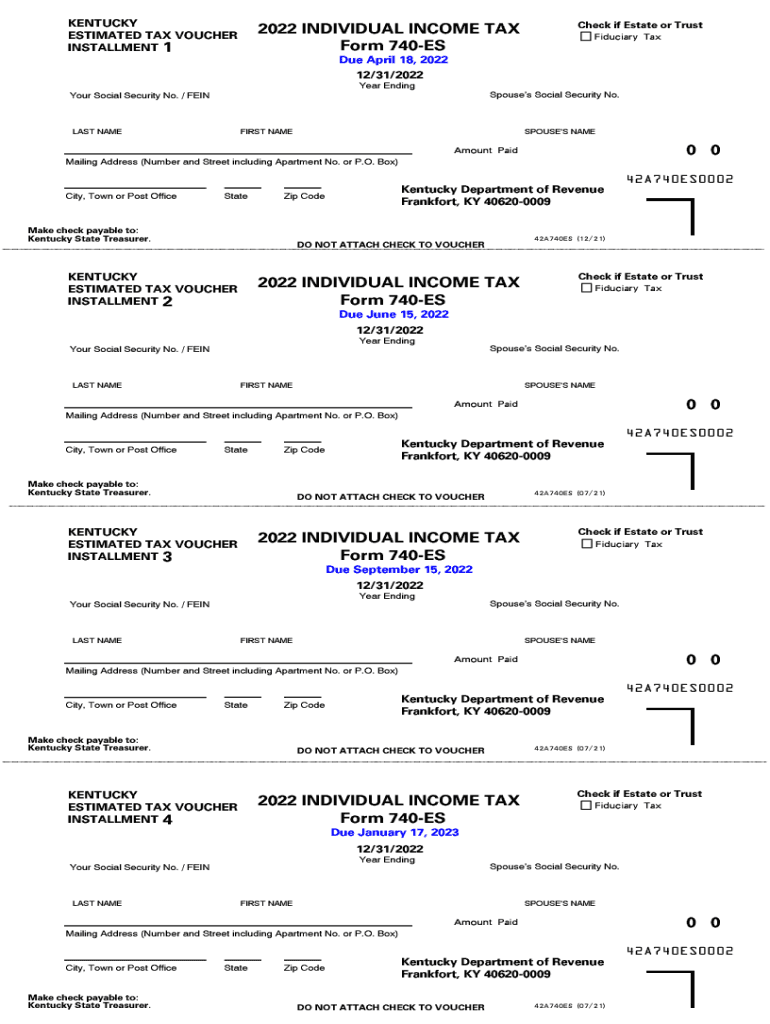

2025 IRS Gov Forms Fillable, Printable PDF & Forms Handypdf, You can print next year's estimated tax. There are four payment due dates in 2025 for estimated tax payments:

Irs Estimated Tax Pa … Rhea Velvet, Alternatives to mailing your estimated tax payments to the irs. When are estimated taxes due?

20202024 MD Form 129 Fill Online, Printable, Fillable, Blank pdfFiller, Estimated tax payments for 2025 are generally due: Final payment due in january 2025.

Irs Form 2290 Printable, If you’re at risk for an underpayment penalty. This interview will help you determine if you’re required to make estimated tax payments for 2025 or if you meet an exception.

Irs Estimated Tax Payment Due Dates 2025 Tove Oralie, When paying estimated taxes, you. You can make estimated tax.

Fillable form 1120 Fill out & sign online DocHub, Estimated tax payments for 2025 are generally due: For 2025 the estimated tax worksheet for.

Ky 740 Es 20222024 Form Fill Out and Sign Printable PDF Template, If you’re at risk for an underpayment penalty. Estimated tax payments for 2025 are generally due:

Estimated Payments Tax Form Fillable Printable Forms Free Online, While the 1040 relates to the previous year, the estimated tax. How do i make estimated tax payments?

Use this secure service to pay your taxes for form 1040 series, estimated taxes or other associated forms directly from your.